Published in FINANCIAL PLANNING JOURNAL: June 2011

Exchange Traded Funds: A Promising Investment Vehicle

Exchange Traded Funds (ETFs) are the investing

innovation that combines the best features of mutual

funds, especially index

funds, with the trading flexibility of individual securities.

Globally they are widely used by planners as the efficient and cost effective tool to take

advantage of investment opportunities around the world. In India,

they have witnessed

major developments over the past couple of years. Some of these

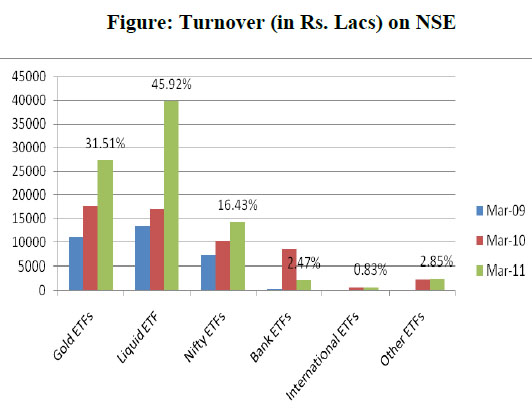

developments, such as consistent growth in their volumes both in terms of trade

and turnover on stock exchanges and launches of new funds

are

positive but some others such as

concentration of assets in Gold ETFs, low retail investors’

participation and disinterest of advisors in promoting ETFs may

not be supportive for the balanced growth of ETFs. These

changes obviously affect

practices of planners and therefore their effect should be

carefully examined. This writing intends

to explore ETFs with a

comparative view of global

trends.

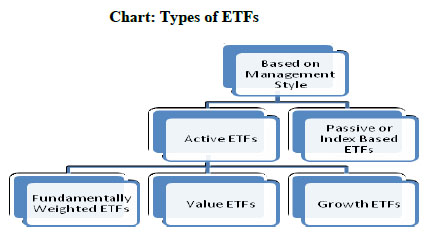

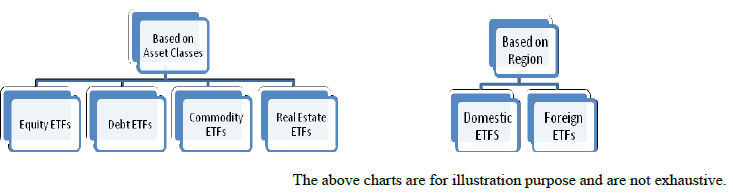

Types of ETFs

ETFs can be

classified on the basis of their management style, the underlying

asset and their investment in

different regions.

Exchange Traded Funds can be efficient vehicles for investing into the capital markets. Financial Planners should weigh all the pros and cons before advising their clients on investing in the same. Here is a detailed understanding.

Shveta Sinha,

CFPCM

Financial Planner,

FPKC

Globally ETFs have several variants among each asset class. Foreign ETFs such as country specific, regional, developed and emerging market ETFs are widely used for geographical diversification. Many of these variants are still relatively new or yet unavailable in India. As planners, we have confronted investors’ query on Gold ETFs. But other ETFs are yet to catch investors’ interest. Currently we have 26 ETFs and all are of passive style except one which is fundamentally weighted ETFs. Among commodity ETFs, the only one available to us is Gold ETFs. As new variants will be rolled out, price competition among providers and better variations of product will be witnessed. An interesting example is Silver ETFs which may be launched in India very soon.

Benefits of ETFs

ETFs offer several advantages

to be a legitimate part of a portfolio:

· ETFs have an edge over index funds in the types of asset classes

covered and their ability to offer intra day liquidity. The

tracking error of an ETF is, normally, lower

than that of an index fund.

· Keeping investment costs low is crucial

to reaching one’s financial goals. Every rupee paid towards

the investment company's overhead is a rupee that disappears

from net returns. Being listed on stock exchanges, ETFs

don’t incur distribution and other operational expenses. Index ETFs

don’t involve the cost of active

fund management and high turnover and therefore are the

cheapest among mutual fund variants.

· The investment objectives of

ETFs are easy to understand. Understanding the underlying asset or

index makes it clear that whether the ETF fits in the

portfolio or not.

· ETFs also offer

diversification and simplicity of transaction.

The Role of Exchange Traded Funds in a Portfolio

To reap the true benefits, ETFs should be

employed strategically. They are effective tools for both long term

and short term or

passive and active investment strategies. Not only individuals, but

even institutions use them tactically

abroad. Pension

funds, insurance companies, investment managers etc use ETFs in

various types of strategies such as to reduce the impact of gaps in style, size

or sector tilt weight and to manage regular inflows and outflows of

cash. To determine what role ETFs would play in a

portfolio, let us understand how to use them in different

investment strategies.

Asset Allocation

Strategies: ETFs tracking major market indices are

one of the best options to be a part of the

core portfolio.

They easily fill asset allocation gap and can be used tactically to

reduce an overweighting or underweighting position of a portfolio. Thus they also

help planners in rebalancing strategies. Specialised ETFs with low

correlation to the core portfolio balance the asset

allocation and augment risk-adjusted return. Gold ETF is one of the

best examples of

specialised commodity ETF as gold don’t have a prominent

correlation with debt and equity.

Cash Drag Minimisation:

ETFs are the perfect vehicle to move frequently into and out of an

entire market or a particular market niche and therefore are

great short term investment options for the active part of the

portfolio. As they are enough liquid, they could be a

temporary investment to park the idle cash of a portfolio which is

allocated to the

equities. This minimises cash drag and avoid potential opportunity

cost till the time investment decisions are

taken to put that

money in work. In such a way, ETFs can be used as alternative of

derivatives which has been used to have temporary exposure.

Loss Minimisation: If the gain of the stock investment needs to be protected, ETFs may be sold short. A better hedge can be obtained by trying to match the characteristics of the index or underlying asset the ETF is based on, with the characteristics of the portfolio being hedged.

Arbitrage Opportunities:

ETFs also present arbitrage opportunities which eliminate any

possibility of trading at premium or discount to the NAV. When the

price of an ETF deviates from the value of the underlying

securities an arbitrage opportunity appears. This type

of movement was noticed in Gold ETFs last year. On 26th May 2010,

the closing price

of Gold Share ( a Gold ETF) was Rs. 1787.65 and the NAV was 1846.77

with a difference of 3.20%.

Taxation:

Taxation is a very important aspect in

financial planning and current Indian income tax laws favour ETFs.

All equity ETFs

are taxed as per equity mutual fund taxation while any non-equity

ETFs are taxed as per debt mutual fund taxation. Therefore Gold ETFs provide an

additional benefit over investment in physical gold as they enable

to claim long

term capital gain after a period of one year of investment and also

aren't subject to wealth tax.

It should be noted that the transaction

costs of ETFs (the brokerage charged by the stock broker) also

include certain statutory charges. These charges cover

service tax, education cess, stamp duty, STT etc.

Limitations of ETFs: A Comparative Study

Just like other investment options, ETFs are not free from

limitations. First of all, they are exposed to bid - ask

spread. What sellers are willing to get may be more than what

buyers want to pay and a wider spread eats returns of

ETFs. For the well traded ETFs, spreads are usually tiny, but

for ETFs with lower assets or volume, the gap can be

much wider. Sometimes an ETF’s market price can drift away

from its net asset value. This may result from some

persistent illiquidity in the underlying securities and such

situation creates the opportunity for arbitrage which sets the

price of ETF back to equilibrium.

If we take a comparative picture of global v/s Indian trends,

domestic ETFs are far away from their global counterparts.

U.S. market for ETFs is almost of $ 1 trillion. At the end of

February 2011, there were over 2,557 ETFs with assets of

US$1367.4 billion. Domestic ETFs have the AUM of only Rs. 6916

crores (as on 31st March 2011) and 64% of this is concentrated

in Gold ETFs.

There are a few limitations which implies particularly for ETFs in

our mutual fund industry. The one which is most important from

financial planning perspective is the limitations associated with

indices. As against the plethora of indices available in the

international market, India has just two popular indices- Nifty and

Sensex. Sensex with just 30 stocks and Nifty with 50 stocks

cover a relatively small number of stocks and ignore many

opportunities in the midcap sector. They are also skewed

towards a few sectors and stocks. Therefore domestic ETFs have not

been able to challenge other equity funds on the ground of

performance. To understand it, we will compare the return of a

typical index fund- HDFC Index Fund- Sensex and an index fund

with an element of active fund management, i.e. HDFC Index

Sensex Plus. Upto 20% of the net asset of HDFC Index Sensex Plus is

actively managed. Having equal expense ratio, it has delivered

almost 40% extra return in one year and 57% extra return in 5-year

horizon in comparison of HDFC Index Fund - Sensex (as on 31st

March 2011). The fact is that many actively managed funds

comfortably outperform the index over longer time frame. India

is a developing economy and many stocks are still

underresearched here. This gives fund managers several

opportunities to outperform the index.

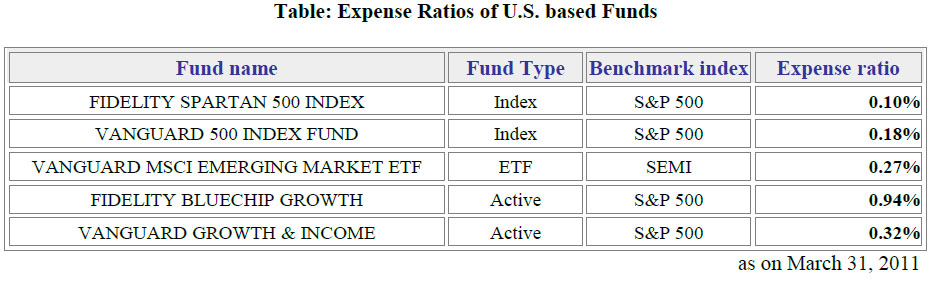

With the end of mutual fund entry load regime, the transaction cost

of an ETF may look like an additional cost. Further it is

argued that passive funds shouldn’t have high expenses. To examine

it, let us have a look at the expense ratios of a developed

mutual fund market like the US.

Domestic ETFs have expense ratio in the region of 0.50% to 1.50%. Small size of AUM is the main factor behind high expense ratio. With the growth of mutual fund industry, this ratio is expected to decline.

Planner’s

Outlook:

The scope of ETFs will increase as our

market matures. But today there are few options available in

ETF industry and

only a planner can help his clients to get the best from ETFs.

While designing an appropriate strategy according to his client’s

requirement, planners need to be very careful so that the

associated limitations mayn’t put any adverse impact

on the investment target. ETFs have witnessed apathy from

both mutual fund

advisors and stock brokers and therefore planners need to play a

larger role here.

![]() CERTIFIED FINANCIAL

PLANNERCM and CFPCM are

certification marks owned outside the U.S. by Financial Planning

Standards Board Ltd. (FPSB Ltd.). Financial Planning Standards

Board India is the marks licensing authority for the

CFPCM marks in India, through agreement with FPSB.

CERTIFIED FINANCIAL

PLANNERCM and CFPCM are

certification marks owned outside the U.S. by Financial Planning

Standards Board Ltd. (FPSB Ltd.). Financial Planning Standards

Board India is the marks licensing authority for the

CFPCM marks in India, through agreement with FPSB.